The Only Guide for Personal Guarantee Lease

Since it is unsecured, an individual assurance is not linked to a details asset. Nonetheless, in the event of non-payment a lender can go after the guarantor's individual possessions. Lots of loan providers call for an individual guarantee as an "added guarantee" that the owner or executive is committed to the business and is committed to settling the tools lease or finance.

The basic guideline is that any type of owner of 20% or more of the equity of an organisation must directly ensure the lease and also loan commitments of the business. For the most part a small- or medium-sized entrepreneur' individual financial resources are linked with the service, so it is affordable that a lessor or loan provider would certainly desire this assurance.

Because most of the times a little- or medium-sized entrepreneur' individual funds are co-mingled with business, so is the partner's financial resources. Not all SMBs are required to authorize. The exemptions consist of big, well established SMBs with profits surpassing $25 million; public firms registered on a public stock exchange like NASDAQ; charitable firms; venture-backed business; and services structured as ESOPs.

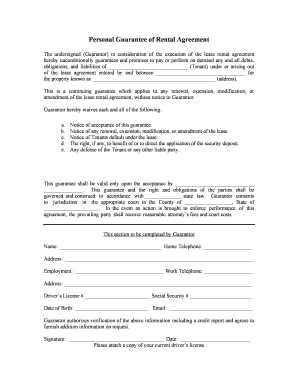

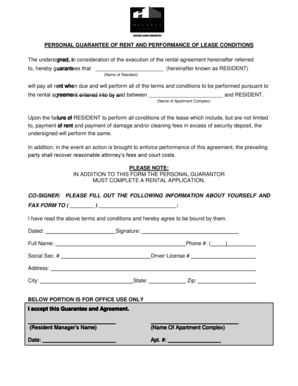

Be careful regarding authorizing an individual warranty if you are not component of the exec management group and do not truly have a complete view of the business's strategies or funds. If you are unsure, think about having your lawyer testimonial the file. The personal warranty will certainly state that you are personally liable for the lease or finance commitments of your company as well as might additionally proclaim that you are liable for default interest, lawful and various other fees.

Personal Guarantee Commercial Lease Fundamentals Explained

If you are not appropriately launched from the personal guarantee you will still be held accountable if the lease or financing enters into default. You may be required to pay off the lease as part of the sale of the service. Personal assurance picture thanks to Shutterstock (personal guarantee lease).

I am attempting to rent some area for my organisation, under my C Corp, and also the landlord has actually requested an individual guarantee of the lease under my name. I talked with my legal representative, who informed me that the personal guarantee provided properly limitless personal obligation in particular unusual cases. Nonetheless, the property owner claims everyone in the shopping mall signs this particular lease, and has no worry with it.

My gut states to simply walk away, and also my legal representative clearly doesn't think it's an excellent clause. I wonder what r/entrepreneur's experiences are with individual guarantees?.

Need to you ever before give an individual guarantee when you're attempting to safeguard a loan?That's an inquiry a great deal of entrepreneurs contemplate as well as dread - how to get out of a personal guarantee on a commercial lease. Besides, that desires to pledge personal properties, such as your home, as collateral? It's secure to say that few individuals do, yet sometimes you need to suck it up. All loan providers are careful of companies that do not have assets or a track record of borrowing.

The smart Trick of Personal Guarantee Commercial Lease That Nobody is Discussing

That indicates if your company has $20 million in revenue or less, you're not going to obtain a loan-- or at the very least a finance at any type of sort of tasty rate of interest-- without a individual guarantee. What is a personal guarantee? An individual assurance is an unsecured, documented promise from a company owner and or business exec to a lending institution guaranteeing settlement on a tools lease or loan in the event the business does not meet their commitment.

Nevertheless, in the event of non-payment a lender can go after the guarantor's personal assets. If you rely on your company and also recognize you have an excellent services or product, it must go a lengthy means in relaxing any type of issues you could have regarding a personal guarantee. And also, you had to have self-confidence in the starting point if you assumed a lending was the method to make your firm grow additionally or faster.

Certainly, the bigger the share, the larger the amount of skin in the video game. Make certain to bring as much details with you when you consult with a loan provider. That includes economic declarations, future earnings forecasts and, ideally, a great individual debt rating. Keep in mind, too, that you can discuss with your lender-- you don't necessarily have to accept their initial terms.

Having a monetary advisor or legal counsel at the negotiating table can help see to it you're not steamrolled. Preferably, work out in provisions that lower the guarantees gradually as you make repayments or program earnings development. One point you ought to not do: Include your spouse as a guarantor. This adds some protection as individual properties under the spouse's name will not be consisted of in the individual guarantee.

The Of How To Get Out Of A Personal Guarantee On A Commercial Lease

What choices do you have? Bear in mind, you generally have options. One opportunity is to merely discard the mixture of cash. Certain, you'll possibly expand at a slower rate as well as might lose out on some opportunities, yet if it's a lot more crucial for you to be able to sleep during the night, so be it.

While the idea of getting resources without getting a loan seems attractive, there can be challenges. For one thing, you're offering up a level of control in your firm. If your companion agrees with you, there's not a problem. Yet what happens if you differ? That may incapacitate your choice making and, in severe cases, you might discover on your own started from your own firm, relying on just how much equity you relinquish.

Published on: Sep 19, 2018Like this column? Authorize up to register for email signals and you'll never ever miss a post. The viewpoints revealed here by Inc.com reporters are their very own, not those of Inc.com.

This article will review what an Excellent Warranty is, some typical false impressions, and also the possible benefits and also mistakes to property managers, lessees, and also guarantors (personal guarantee lease). In virtually all dining establishment leases, the lessee under the lease is a restricted responsibility business or other kind of company entity made to restrict the personal liability of the business's owner.

have a peek at this website